The Lazard annual report on the Levelized Cost of Storage LCOS 3.0 was released today with the Lazard Levelized Cost of Energy report LCOE 11.0

Go to LCOE 3.0 Report and Executive Summary

LAZARD RELEASES ANNUAL LEVELIZED COST OF ENERGY AND LEVELIZED COST OF STORAGE ANALYSES

– LCOE 11.0 shows continued cost declines for utility-scale wind and solar energy –

– LCOS 3.0 shows declining but widely variable battery storage costs –

NEW YORK, November 2, 2017 – Lazard Ltd (NYSE: LAZ) has released its annual in-depth analyses comparing the costs of energy from various generation technologies and of energy storage technologies for different applications.

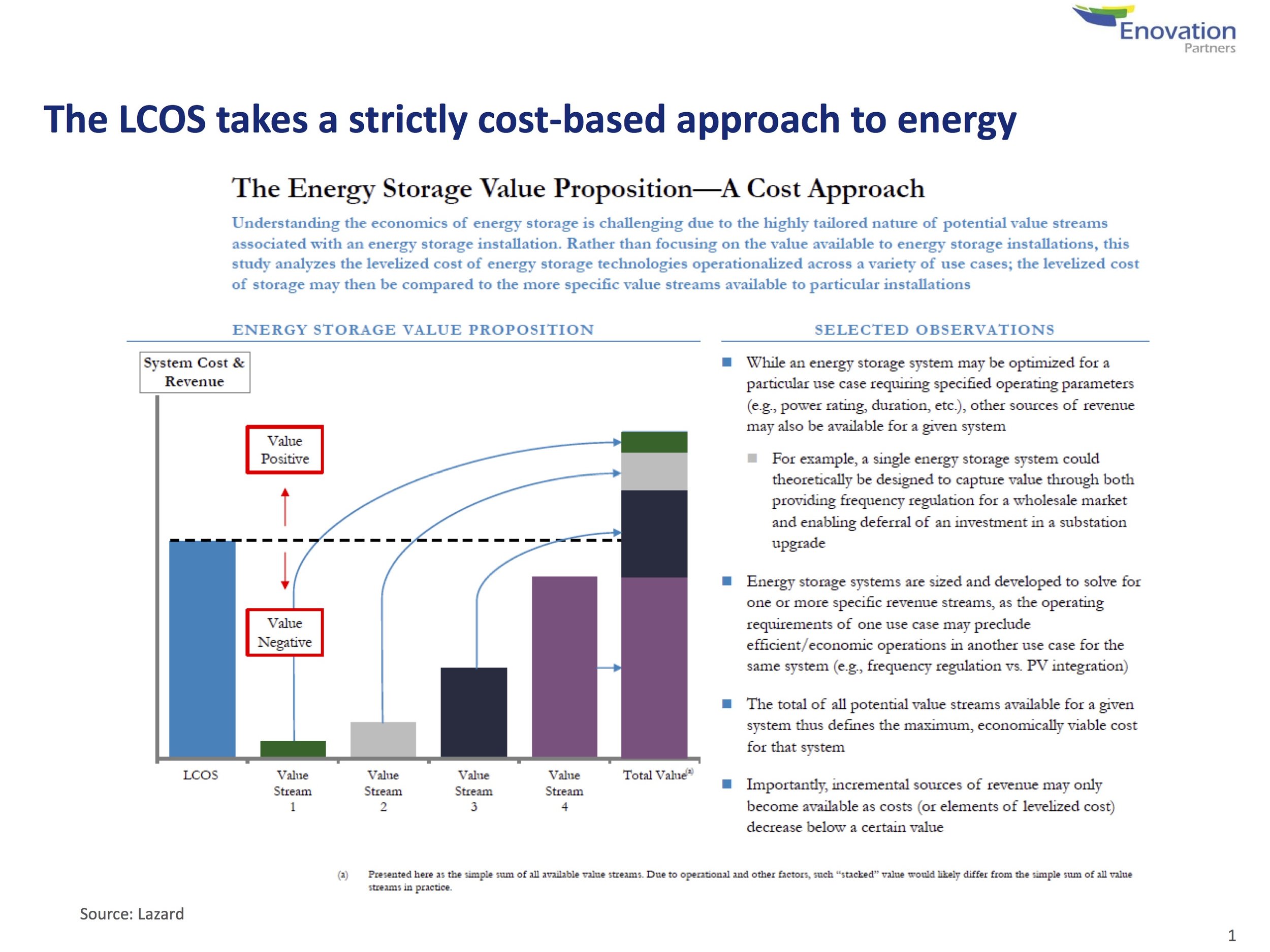

Lazard’s latest annual Levelized Cost of Energy Analysis (LCOE 11.0) shows a continued decline in the cost of generating electricity from alternative energy technologies, especially utility-scale solar and wind. Lazard’s latest annual Levelized Cost of Storage Analysis (LCOS 3.0), conducted with support from Enovation Partners, shows declining cost trends among commercially deployed technologies such as lithium-ion, but with wide variations depending on the type of application and battery technology.

“The growing cost-competitiveness of certain alternative energy technologies globally reflects a number of factors, including lower financing costs, declining capital expenditures per project, improving competencies and increased Industry competition,” said George Bilicic, Vice Chairman and Global Head of Lazard’s Power, Energy & Infrastructure Group.

“That said, developed economies will require diverse generation fleets to meet baseload generation needs for the foreseeable future.” “Energy industry participants remain confident in the future of renewables, with new alternative energy projects generating electricity at costs that are now at or below the marginal costs of some conventional generation,” said Jonathan Mir, Head of Lazard’s North American Power Group. “The next frontier is energy storage, where continued innovation and declining costs are expected to drive increased deployment of renewables, which in turn will create more demand for storage.”

The two studies offer a variety of insights, including the following selected highlights:

LCOE 11.0

- As LCOE values for alternative energy technologies continue to decline, in some scenarios the full lifecycle costs of building and operating renewables-based projects have dropped below the operating costs alone of conventional generation technologies such as coal or nuclear. This is expected to lead to ongoing and significant deployment of alternative energy capacity.

- Global costs of generating electricity from alternative energy technologies continue to decline. For example, the levelized cost of energy for both utility-scale solar photovoltaic (PV) and onshore wind technologies are down approximately 6% from last year.

- Despite the modestly slowing rate of cost declines for utility-scale alternative energy generation, the gap between the costs of certain alternative energy technologies (e.g., utility-scale solar and onshore wind) and conventional generation technologies continues to widen as the cost profiles of such conventional generation remain flat (e.g., coal) and, in certain instances, increase (e.g., nuclear). Specifically, the estimated levelized cost of energy for nuclear generation increased ~35% versus prior estimates, reflecting increased capital costs at various nuclear facilities currently in development.

- Although alternative energy is increasingly cost-competitive and storage technology holds great promise, alternative energy systems alone will not be capable of meeting the baseload generation needs of a developed economy for the foreseeable future. Therefore, the optimal solution for many regions of the world is to use complementary conventional and alternative energy resources in a diversified generation fleet.

LCOS 3.0

- Among commercially deployed technologies, lithium-ion continues to provide the most economical solution across use cases analyzed in the LCOS, although competing flow battery technologies claim to offer lower costs for certain applications.

- Although energy storage technology has created a platform for discussions related to certain transformational scenarios, such as consumers and businesses “going off the grid”, it is not currently cost competitive in most applications. However, under some scenarios, certain applications of energy storage technologies are attractive; these uses relate primarily to strengthening the power grid and accessing cost savings and other sources of value for commercial and industrial energy users through reducing utility bills and/or participating in demand response programs.

- Industry participants expect costs to decrease significantly over the next five years, driven by scale and related cost savings, improved standardization and technological improvements, supported in turn by increased demand as a result of regulatory/pricing innovation, increased renewables penetration and the needs of an aging and changing power grid in the context of a modern society. The majority of future cost declines are expected to occur as a result of manufacturing and engineering improvements in batteries. Cost declines projected by Industry participants vary widely among energy storage technologies, but lithium-ion capital costs are expected to decline as much as 36% over the next five years.

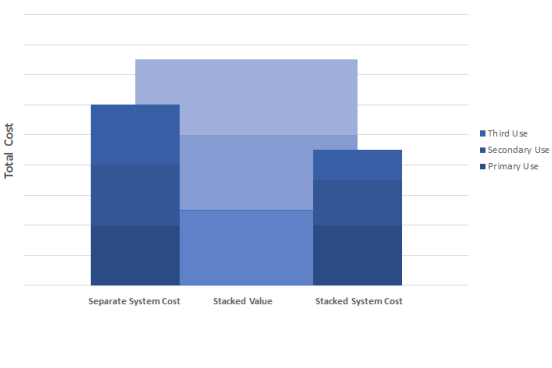

- As the energy storage market continues to evolve, several potential sources of revenue streams available to energy storage systems have emerged. However, the ultimate mix of available revenue streams for a particular energy storage system varies significantly across geographies.

- LCOE 11.0 and LCOS 3.0 reflect Lazard’s commitment to the sectors in which it participates. The two studies are posted at www.lazard.com/perspective.

Lazard’s Global Power, Energy & Infrastructure Group serves private and public sector clients with advisory services regarding M&A, financing and other strategic matters. The group is active in all areas of 3 the traditional and alternative energy industries, including regulated utilities, independent power producers, alternative energy and infrastructure.

About Lazard

Lazard, one of the world's preeminent financial advisory and asset management firms, operates from 43 cities across 27 countries in North America, Europe, Asia, Australia, Central and South America. With origins dating to 1848, the firm provides advice on mergers and acquisitions, strategic matters, restructuring and capital structure, capital raising and corporate finance, as well as asset management services to corporations, partnerships, institutions, governments and individuals.

For more information on Lazard, please visit www.lazard.com. Follow us at @Lazard.

Link to source: Lazard Press Release for LCOS 3.0