Ancillary Services and Energy Storage Markets

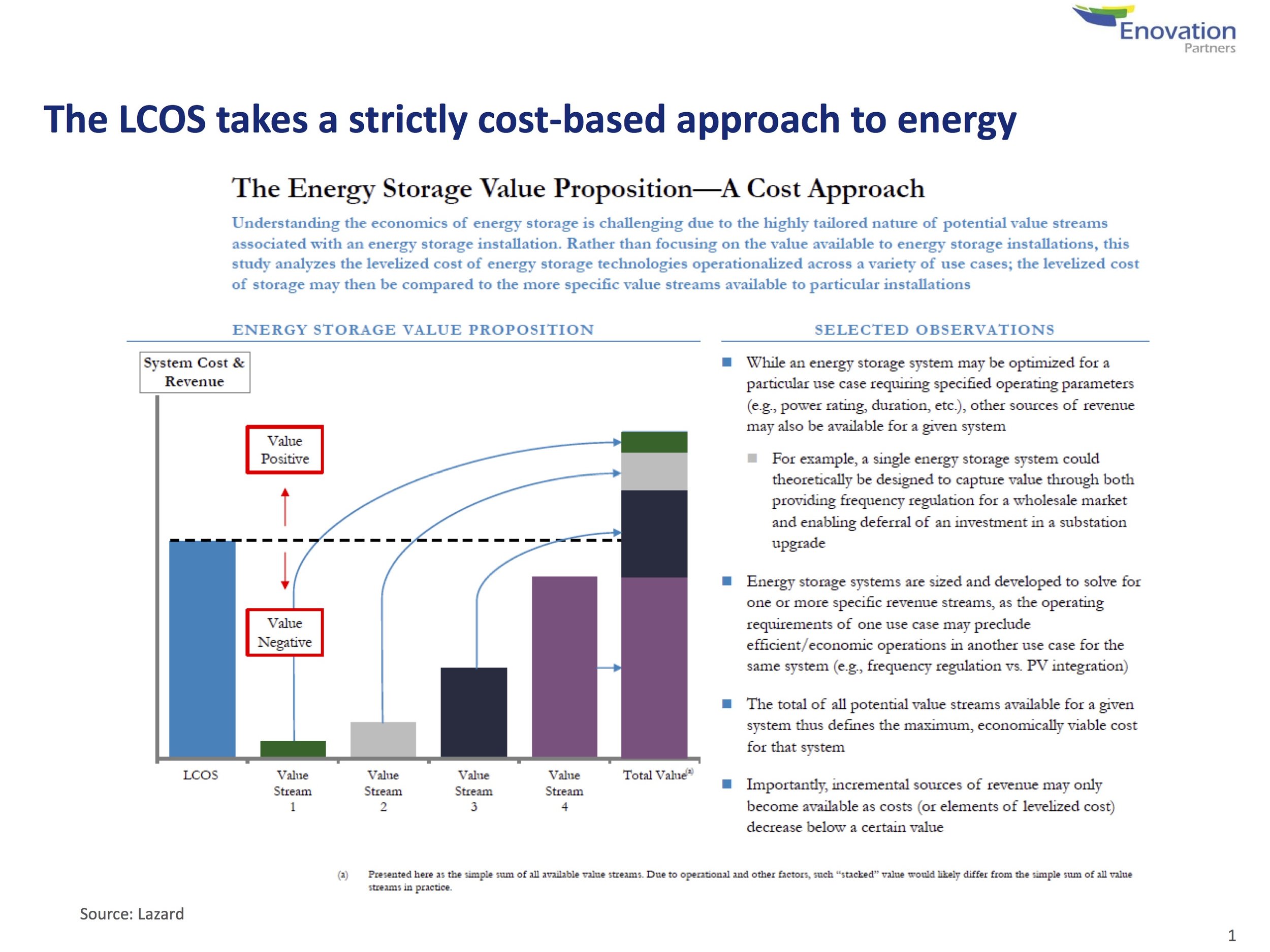

Ancillary services – Frequency Regulation, in particular – has been critical to achieving desired hurdle rates among front-of-the-meter storage projects in deregulated markets. However, given finite size and price sensitivities in these markets, what will be the impacts for developers? We have extensive thoughts on the topic here at Enovation Partners, and, suffice to say, “the devil is in the details” when considering the answer.

The structure and rules of many ancillary service markets are complex, leading to unforeseen outcomes and disruptions when a new technology bursts on to the scene. If ancillary services products are configured with storage in mind (e.g. discharge duration, compensation for speed), there is a great fit with current storage capabilities.

However, markets are small:

Hinderances to storage adoption

Further obstacles to storage adoption come from each market’s complex pricing mechanism. In many cases, there is no simple price-setting mechanism in terms of supply/demand, and in other cases there is very little competition or price transparency.

Examples:

PJM’s frequency regulation rules from 2012 encouraged a boom in storage, during which time owners and operators of storage benefitted from favorable market rules and compensation mechanisms (e.g. pay-for-performance). Commitment to net neutral signals for storage and limits on sustained signal durations leading to batteries acting out of harmony with system needs, and – at least from the Market Monitor’s perspective – overcompensation for Frequency Regulation resources following the Reg D signal.

In 2017, PJM changed its rules around neutral signals, signal intensity, and settlement mechanisms in a manner that left storage owners with significantly less revenue and, for some, substantially accelerated battery degradation. These rule changes were struck down after in an April 2018 ruling leading to a correction in pricing and signal. FERC has requested a technical conference for late 2018, and thus the wheel of time continues for PJM Reg D.

In New York, a potential state mandate of 1.5 GW of storage would create a market disconnect by injecting new, potentially uneconomic supply to meet a largely unchanging demand.

Frequency regulation market price declines by 90% following the installation of a 100 MW Tesla battery in South Australia - frequency regulation products were previously priced by units with highly volatile variable prices

Conclusion

We expect markets to struggle when there are swift changes to underlying technologies in a Regulation supply stack. Storage’s innate ability to provide ancillaries faster and cheaper than current price setting units will drive a step change in clearing prices as storage usurps gas-fired generation as the marginal unit.

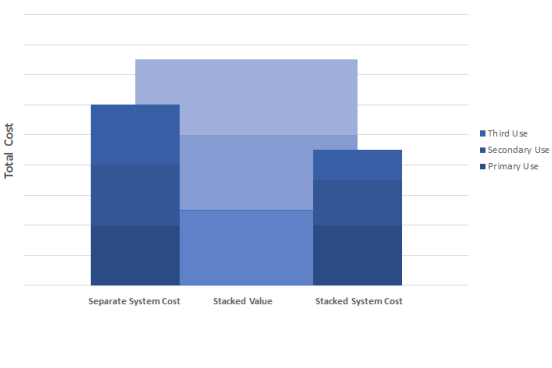

At Enovation, we expect price drops to reflect the delta in the units’ marginal prices to provide ancillaries. As a result, market sensitivity to dramatic price changes in the near-future as storage projects could have dramatic implications for future development decisions by Independent Power Producers and investors. Prudent developers should have a clear idea of how additional market entry can impact pricing, and hedge by configuring systems to earn other revenue streams.

What does this mean for the economics of storage projects? How will overall storage penetration be affected? Are mandates achievable? Enovation Partners’ expertise and analytics capabilities guides our clients through issues like this everyday